Fha loan affordability calculator

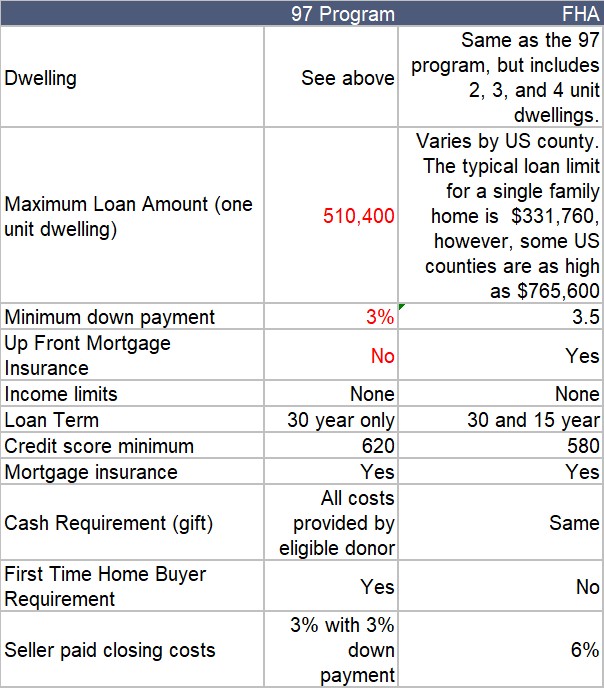

To determine how much house you can afford use this home affordability calculator to get an estimate of the home price you can afford based upon your income debt profile and down payment. For conventional loans the minimum is 3 percent for certain buyers and 5 percent for most.

Home Loan Calculators And Tools Hsh Com

Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan.

. In the following example a borrower obtained an FHA loan of 275000 to purchase a home. But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional mortgages. The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and theres plenty of good reasons why.

For FHA loans down payment of 35 percent is required for maximum financing. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility. In the Debt-to-Income Ratio drop-down selection there is an option for FHA loan.

Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan. As of today the value has. This is an estimate of how much you will need on the day your home purchase is made.

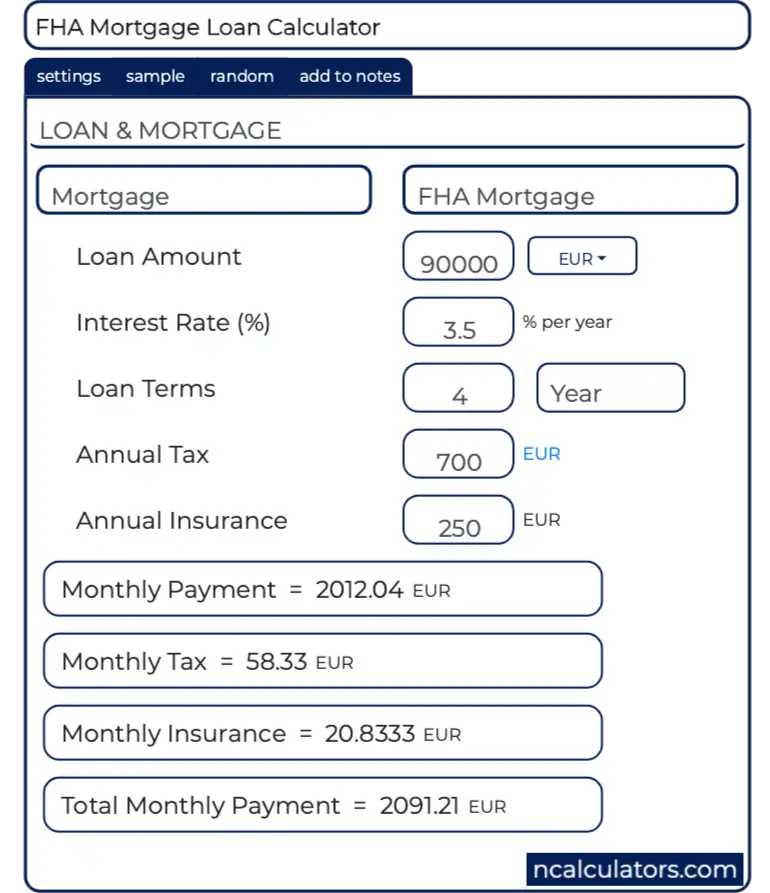

HUD 40001 page 135. How much can you borrow from the FHA. Estimate your taxes and insurance so that these amounts will be included in the payment calculation.

They require low down payments of 35 and low closing costs. As of 2022 FHA loan limits range between 420680 to 970800. Benefits of FHA Loans.

These factors are used to make a payment or. HUD analyzes local real estate markets to set maximum limits on FHA loan amounts. With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

An affordability calculator is a great first step to determine how much house you. Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. What is the purpose of this program.

Now that you have your estimated home price check out different loan options with our Mortgage Calculator. The minimum down payment for an FHA loan is 35 percent. We have published information about FHA appraisal standards for septic systems in the past but since the advent of updated FHA loan guidelines in the form of HUD.

Mortgage loan basics Basic concepts and legal regulation. Loan Affordability Payment Calculator. Use our free FHA loan calculator to find out your monthly FHA payment.

Loan Affordability Payment Calculator. The FHA loan calculator accounts for UFMIP FHA MIP required down payment and the variances resulting in interest rate and loan term variables. Borrowers must pay for mortgage insurance in order to protect lenders from losses in.

The FHAHUD official site has a section that explains the hows and whys of the FHA 203b loan. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Check out our affordability calculator and look for homebuyer grants in your area.

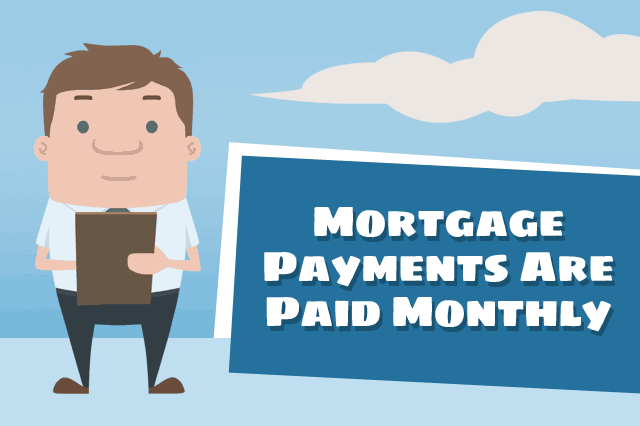

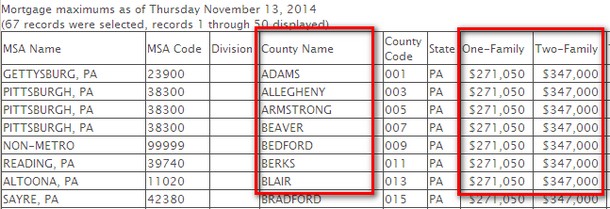

To know your countys mortgage limits you can enter area information at the HUD mortgage limits page. The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and theres plenty of good reasons why. Please remember that this is an estimate the actual fees and expenses may change depending on a variety of factors including the actual closing date.

Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan. Many first-time homebuyers and buyers with poor credit scores choose. Know Your FHA Loan Limits.

Use our home affordability calculator and get on the road to your dream home with Guaranteed Rate. Occupancy is required for both new purchase and FHA cash-out refinance loans. Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans.

To determine the house affordability of an FHA loan please use our House Affordability Calculator. To provide mortgage insurance for a person to purchase or refinance a principal residence. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

This is the dollar amount you put toward your home purchase. Use our fha loan calculator to help you estimate the costs and your monthly payment including mortgage insurance. FHA loan rules in HUD 40001 say that FHA mortgages can never be used for vacation properties timeshares or transient occupancy.

Mortgage calculators determine your monthly principal and interest based on your loan amount loan term down payment and interest rate. An FHA loan is a mortgage insured by the Federal Housing Administration. Limits vary depending on your county.

Use our mortgage calculator to determine your monthly payment amount. Heres a breakdown to help you understand each of the terms and fees included in our FHA loan affordability calculator. It becomes immediately apparent that FHA loans have the most stringent debt-to.

This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income. As of 2021 the FHAs loan limit ceiling sits at 822375 for the countrys highest-cost areas but keep in mind that limit will be much lower for most. The 203b loan mentioned in the question on the other hand is essentially the FHA standard single family home loan.

He makes his monthly payments as agreed. Use this calculator to help estimate the total closing cost to purchase a home using an FHA loan. See a breakdown of your loan costs including FHA mortgage insurance.

Using our FHA Loan Calculator. FHA loans Federal Housing Administration are loans insured by the federal government. Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence with an interest rate of interestRate apr on aprDate for a borrower with excellent credit and.

Low Down Payments and Less Strict Credit Score Requirements. FHA mortgage limits are generally 65 of an areas conforming loan limits. If youre thinking about applying for an FHA home loan to purchase a house served by a septic system you may have questions about the acceptability of the system your potential new home uses.

Please visit our FHA Loan Calculator to get more in-depth information regarding FHA loans or to calculate estimated monthly payments on FHA loans. September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. Visit our mortgage education center for helpful tips and information.

Enter amounts in the fields below and the mortgage calculator will give you your monthly mortgage payment amount. Loan Affordability Payment Calculator.

Usda Home Loan Qualification Calculator Freeandclear

Fha Mortgage Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculators

Downloadable Free Mortgage Calculator Tool

Fha Mortgage Insurance Calculator Anytime Estimate

Fha Mortgage Calculator How Much Can I Afford

Fha Loan Calculators

Fha Loan Calculators

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Fha Mortgage Insurance Calculator Anytime Estimate

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Conventional 97 Loan And Calculator Anytime Estimate

How To Qualify For A Kentucky Fha Home Loan Home Loans Mortgage Loans Fha Mortgage